How to Create Multiple Income Streams: 15 Proven Ways to Diversify Your Income

Did you know that the average millionaire has seven different income streams? That’s right! While most people rely on a single paycheck, financially savvy individuals understand that diversifying their income is key to building lasting wealth. I’ve spent years helping people develop multiple revenue sources, and I’m excited to share the most effective strategies that actually work in 2024. Whether you’re looking to escape the 9-to-5 grind or simply want to build more financial security, this guide will show you exactly how to get started!

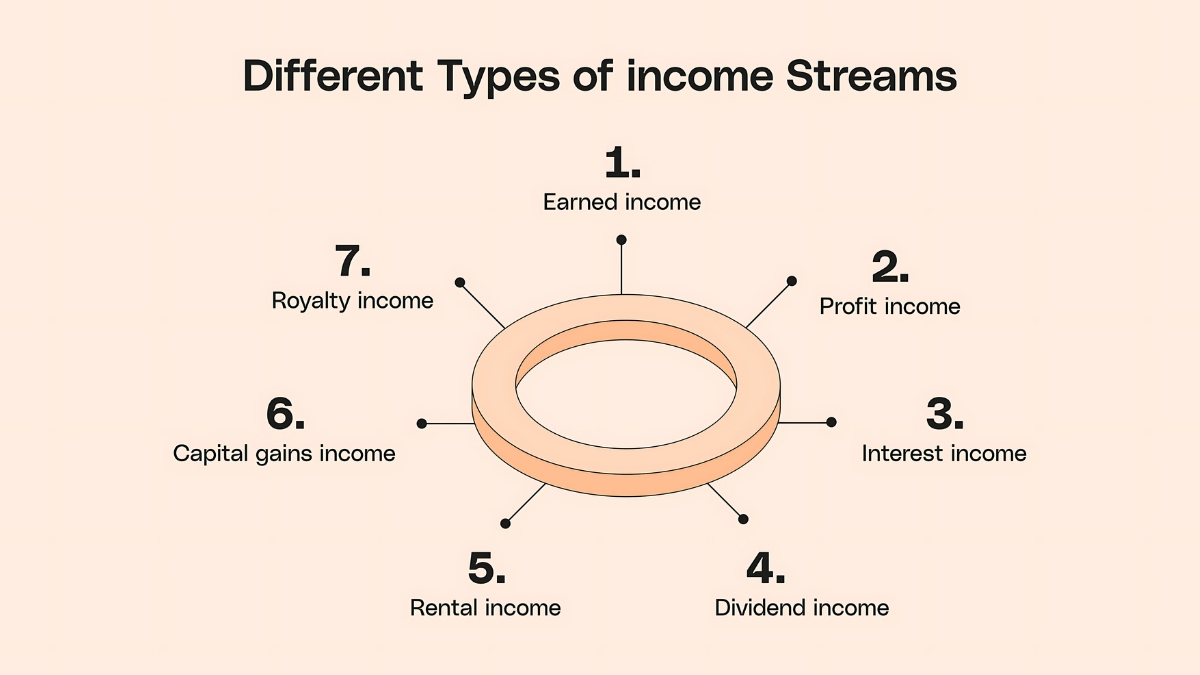

Understanding the Different Types of Income Streams

First up is active income – you know, the “trading time for money” kind of deal. This is your typical 9-to-5 job, freelance work, or consulting gigs. I remember when I first started consulting on the side of my day job. Sure, I was making an extra $2,000 a month, but I was also glued to my laptop every evening. The benefit? It’s reliable and usually pays well. The downside? You only earn when you’re actively working. When I caught the flu last winter, my active income completely stopped for two weeks – talk about a wake-up call!

Then there’s passive income, which honestly isn’t as passive as those YouTube gurus make it sound (trust me, I fell for those promises too!). My rental property is technically “passive,” but between occasional midnight maintenance calls and tenant turnover, it still requires some attention. However, once you’ve got the systems in place, passive income can be pretty amazing. My online course about gardening brings in around $800 monthly, and while I spend about 2-3 hours monthly updating content and answering student questions, it’s way more leveraged than my old consulting work.

Portfolio income is the third type, and it’s been a game-changer for my peace of mind. This includes dividends from stocks, interest from bonds, and capital gains. I started super small – literally $50 a month into dividend-paying ETFs. Five years later, I’m earning quarterly dividends that cover my utility bills. Not exactly retirement money, but it’s growing steadily without requiring my direct involvement.

Here’s something interesting about leveraged versus linear income that nobody told me early on: Linear income (like hourly work) has a ceiling. There are only so many hours in a day, right? But leveraged income? That’s where things get exciting. Take my friend Sarah, for example. She created a template pack for social media managers. She spent about 40 hours creating it, and now it generates $3,000-4,000 monthly through passive sales. That’s leveraged income at its finest!

The most successful entrepreneurs I know combine all three types. They might have a main business (active), some digital products (passive), and a solid investment portfolio (portfolio income). It’s like having different engines powering your financial ship – if one starts sputtering, the others keep you moving forward.

But here’s my biggest takeaway: start with what you know, then gradually expand. I’ve seen too many people try to launch five different income streams at once, only to burn out spectacularly. When I started, I focused on mastering one type at a time. First, I maximized my active income through strategic job moves. Then, I built my first passive income stream with my rental property. Only after those were stable did I dive into portfolio income.

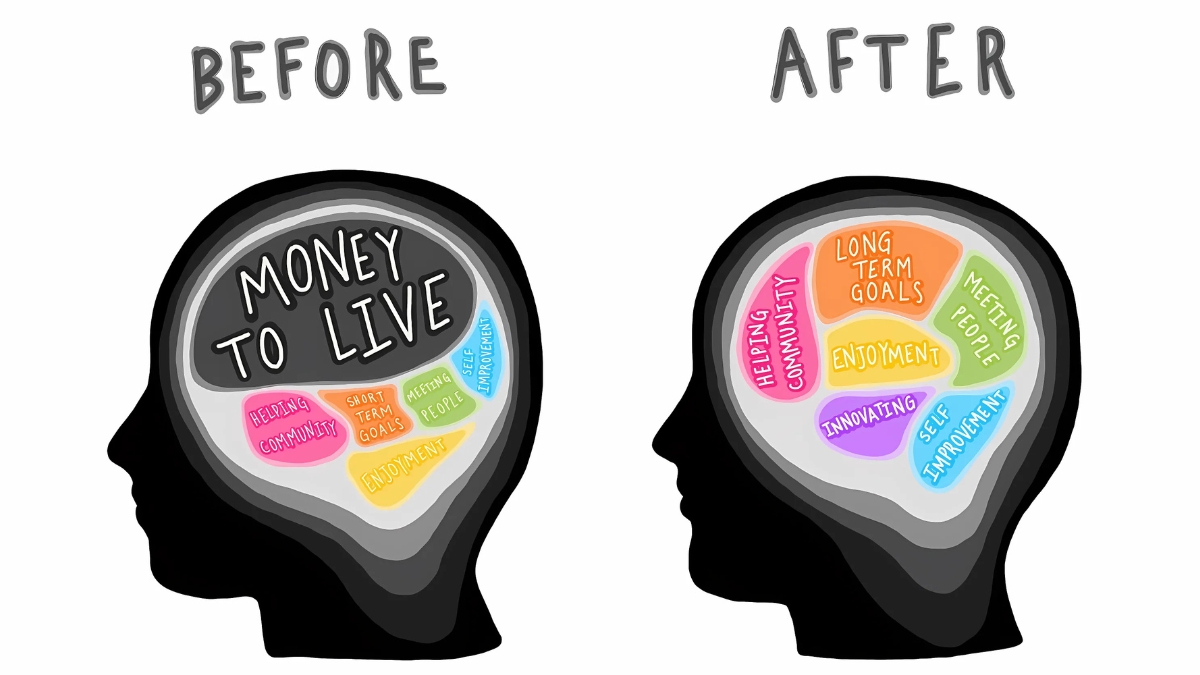

Essential Skills and Mindset for Income Diversification

Want to know the biggest mistake I made when starting my journey with multiple income streams? I jumped in without the right mindset or skillset. Let me tell you, trying to juggle an Etsy shop, freelance writing, and a rental property without proper systems in place was like trying to ride three bikes at once – it got messy real quick!

The first skill I had to develop (the hard way) was basic financial literacy. I remember sitting at my kitchen table one evening, surrounded by receipts and tax documents, realizing I had no clue which expenses belonged to which income stream. These days, I use QuickBooks to track everything separately, and I can tell you exactly how much each venture is making or losing. Pro tip: Set up separate bank accounts for each income stream from day one. Future you will be incredibly grateful during tax season!

Time management isn’t just important – it’s absolutely crucial. I learned this lesson after burning out trying to handle everything myself. Now I follow what I call the “Power Hour System.” Each morning, I spend one focused hour reviewing and working on each active income stream. For example, 7-8 AM is for checking on my online course students and answering questions, 8-9 AM is for my freelance clients, and so on. Having these dedicated time blocks helps prevent that overwhelming feeling of trying to do everything at once.

Here’s something nobody talks about enough: you need to develop your analytical skills. I used to make decisions based on gut feelings, but that led to some costly mistakes. Now I track key metrics for each income stream – things like ROI (Return on Investment), time invested versus money earned, and seasonal patterns. For instance, I noticed my digital products sell better in January and September, so I plan my promotional efforts around these peaks.

Let’s talk about a common fear that held me back initially: the fear of failure. I remember hesitating to launch my first online course because I thought, “What if nobody buys it?” Well, guess what? My first course only made $50 in its first month. But instead of giving up, I used that experience to improve. Now that same course, revised and refined, brings in consistent four-figure monthly income. The key mindset shift was viewing each “failure” as market research.

Another essential skill is what I call “strategic automation.” When I started, I was trying to manually post on social media three times a day for my business. It was exhausting! Now I use tools like Buffer for social media scheduling, Zapier for automating repetitive tasks, and have standard operating procedures (SOPs) for everything. This frees up my time to focus on growth rather than maintenance.

One misconception that trips up many people is thinking they need to be an expert at everything. Trust me, you don’t! I’m not a tax expert, so I have an accountant. I’m not great at graphic design, so I use Canva templates. The real skill is knowing when to delegate or outsource. Sometimes spending $50 on a task that would take you 3 hours is the smarter choice.

Business acumen develops over time, but here’s what I wish someone had told me earlier: start studying successful business models in your field. I spend at least 30 minutes each day reading industry news and analyzing competitors. This helps me spot trends and opportunities before they become obvious. For example, I noticed early on that my competitors weren’t offering mobile-friendly versions of their digital products, so I made that my unique selling point.

Remember, developing these skills is a journey, not a destination. I’m still learning new things every day, and that’s exactly how it should be. The key is to start with one skill, master it, then move on to the next. Don’t try to become an expert at everything overnight – that’s a recipe for overwhelm and frustration. Focus on progress, not perfection, and keep building your skillset one step at a time.

And here’s my final piece of advice: document everything you learn. I keep a “lessons learned” journal where I write down what works, what doesn’t, and why. This has become an invaluable resource as I continue to grow and diversify my income streams. After all, the best teacher is experience, but only if you take the time to learn from it!

Traditional Income Stream Opportunities

Let me share something that totally changed my perspective on traditional income streams. Back in my early days of income diversification, I was so caught up in chasing “hot” new online opportunities that I completely overlooked the goldmine of traditional options right in front of me. Big mistake! These tried-and-true income streams have been creating wealth for decades, and there’s a good reason why.

Let’s talk about part-time work and consulting first. I remember accepting my first consulting gig – I was terrified! But here’s what I discovered: companies are desperately willing to pay premium rates for specialized knowledge. I started charging $75 per hour for marketing consulting, and you know what? Clients didn’t blink an eye. The key is to focus on a specific niche where you have expertise. For example, I knew email marketing inside and out from my day job, so that became my consulting sweet spot. Pro tip: Start with local businesses in your area. They’re often overlooked but usually have decent budgets and love working with local experts.

Now, rental property income – this one’s been a rollercoaster ride! My first rental property taught me some expensive lessons (like the time I had to replace an entire HVAC system in the middle of summer). But here’s what I’ve learned about making it work: the 1% rule is your best friend. This means the monthly rent should be at least 1% of the purchase price. For instance, a $200,000 property should rent for at least $2,000 monthly. I now use this rule religiously when evaluating potential properties. Also, consider house hacking – that’s how I started. I bought a duplex, lived in one unit, and rented out the other. The tenant’s rent covered most of my mortgage!

Dividend investing was honestly the most intimidating stream for me at first. All those financial terms made my head spin! But I started small with dividend-paying ETFs, and it’s been one of the most reliable income streams I’ve built. I began with just $200 monthly investments in SCHD (Schwab U.S. Dividend Equity ETF), and watched it grow over time. The key lesson here? Dividend investing is a slow-burning stream that compounds beautifully over time. Don’t expect to get rich quick, but do expect to build wealth steadily.

Small business ownership has probably taught me the most valuable lessons. After watching my sister struggle with her brick-and-mortar boutique, I realized the importance of starting lean. These days, I recommend people start with a hybrid model. For instance, one of my mentees began selling handmade jewelry both online and at local markets. This gave her the best of both worlds – online reach and personal customer interaction – without the overhead of a physical store.

Here’s something nobody tells you about traditional income streams: they’re actually easier to finance than modern ones. Banks understand rental properties and small businesses. Try getting a loan for a cryptocurrency mining operation, and you’ll see what I mean! I’ve found that traditional lenders are much more willing to work with you on conventional investments.

The real magic happens when you start combining these streams strategically. For example, I use the dividend income from my investments to help cover property maintenance costs on my rental. The consulting income provides extra cash flow that I can reinvest into growing my small business. It’s like creating your own personal money ecosystem!

But let me be real with you – managing traditional income streams isn’t always glamorous. Sometimes it means answering tenant calls at midnight or spending weekends working with consulting clients. However, these streams tend to be more stable and predictable than many newer options. Plus, there’s usually less competition because everyone else is chasing the latest online trend!

One final piece of advice: don’t overlook the power of local networking for traditional income streams. My most profitable consulting contracts came from local business group meetings, not online marketing. There’s something about face-to-face connections that still carries immense value in traditional business settings.

Remember, these traditional opportunities have created wealth for generations – they’re not flashy, but they work. Start with the one that best matches your current skills and resources, then gradually expand from there. And always, always keep some cash reserves for those unexpected HVAC replacements!

Digital and Online Income Streams

Let me start with a confession: my first digital product was a complete flop. I spent three months creating what I thought was the perfect ebook about container gardening, launched it to crickets, and made exactly two sales (pretty sure one was my mom). But you know what? That failure taught me more about digital income streams than any success could have.

Let’s talk about creating digital products that actually sell. The game-changer for me was when I started asking my audience what they wanted BEFORE creating anything. I now run small pilot programs first – usually with about 10-15 people who get early access at a discount. For example, before creating my full online course about Instagram marketing, I ran a live workshop series with 12 students at half price. Their feedback was pure gold! They helped me identify gaps in my content that I would’ve never spotted on my own. Now that same course generates around $3,000 monthly with minimal maintenance.

Building an online presence feels like growing a garden – it takes time and consistent care. I made the mistake of trying to be everywhere at once: Facebook, Instagram, Twitter, Pinterest, YouTube… talk about spreading yourself thin! These days, I focus on two platforms where my audience actually hangs out. For my niche, that’s Instagram and LinkedIn. Pro tip: Choose platforms based on where your target audience spends their time, not what’s trending. I post three times a week consistently, and that works way better than posting daily on six different platforms.

Now, about affiliate marketing – this one’s tricky but can be incredibly rewarding when done right. The key is to only promote products you actually use and love. I learned this lesson after promoting a social media scheduling tool just because it had high commission rates. The guilt from unhappy customers who bought through my link wasn’t worth the extra dollars. Now I only promote tools I’ve used for at least three months in my own business. My favorite example is my website hosting company – I genuinely love their service and earn about $800 monthly just from recommending them to my audience.

Freelancing platforms opened up a whole new world of opportunities for me, but they’re not all created equal. I started on Upwork charging $15 per hour for copywriting (yeah, I know, way too low). After building up my ratings and portfolio, I gradually increased my rates. Now I charge $125 per hour for the same work, but I’m much more selective about which projects I take on. The key is to specialize – don’t be a general virtual assistant or writer. I niched down to writing sales pages for SaaS companies, and that specialization made all the difference.

Here’s something nobody talks about enough: the importance of systems for digital income. I used to waste hours every week on repetitive tasks until I created my “Digital Business Bible” – a Google Doc with all my standard operating procedures. Every time I do something more than twice, it goes in there. This includes everything from my email response templates to my content creation workflow. This system saves me about 10 hours every week!

One big misconception about digital income streams is that they’re totally passive. Sure, my digital products bring in money while I sleep, but they need regular updating and maintenance. I block out the first Monday of every month to check all my digital assets – updating links, responding to customer questions, and tweaking content based on feedback. It’s like giving your car regular oil changes – a little maintenance prevents bigger problems down the road.

The real secret to successful digital income streams? Build an email list from day one. I wasted two years creating content on social media without capturing email addresses. Now my email list is my most valuable asset. When I launch a new digital product, about 80% of sales come from my email subscribers. Start with a simple lead magnet – mine was a one-page checklist for optimizing Instagram profiles. Nothing fancy, but it works!

Remember, digital income streams take time to build, but they can scale incredibly well once you have the foundations in place. Start with one stream, master it, then add another. And please, learn from my mistakes – validate your ideas before spending months creating something nobody wants!

Passive Income Stream Development

Can I be totally honest with you? The term “passive income” is one of the most misunderstood concepts I’ve encountered. When I first started my journey, I thought passive meant I could set it up on Monday and be sipping margaritas on the beach by Friday. Boy, did I learn that lesson the hard way!

Let’s talk about creating automated income systems that actually work. The key word here is “systems.” I spent about three months setting up my first real automated funnel for my digital planners. Here’s what it looks like: Pinterest pins lead to my landing page, visitors get a free mini-planner, they join my email list, and then they receive an automated sequence of valuable emails mixed with offers for my premium planners. It took forever to set up, but now it runs like clockwork, bringing in around $2,000 monthly with just a few hours of maintenance.

Investment opportunities were my next focus for passive income. I remember staring at my first dividend statement – a whopping $1.87! Not exactly retirement money, right? But here’s what I’ve learned: REITs (Real Estate Investment Trusts) can be a fantastic source of passive income without the headaches of being a landlord. I started with $5,000 in a REIT that focuses on apartment buildings, and now I receive quarterly distributions that actually make a difference in my monthly budget. The key is reinvesting those dividends in the beginning – it’s like giving your money steroids!

Now, let’s chat about royalty-based income – my secret weapon for truly passive income. I partnered with a musician to create background music for meditation apps. We split the royalties 50/50, and while it’s not making us millionaires, those monthly payments of $300-500 show up like clockwork. The best part? We did the work once, three years ago! Pro tip: Look for opportunities in unexpected places. Stock photos, music licensing, and even voice-over work can generate royalty income.

Print-on-demand has been an interesting journey. My first attempt at selling t-shirts was pretty embarrassing – I created designs I thought were hilarious, but nobody else did! The game-changer was when I started creating designs based on specific niches. For example, I made a series of shirts for kindergarten teachers, and they sell consistently throughout the school year. No inventory, no shipping headaches, and the platforms handle everything. I use both Printful and Merch by Amazon, bringing in about $800-1,200 monthly from designs I created two years ago.

Here’s something crucial about automation: you need to build in regular check-ins. I learned this when my automated email sequence was sending out expired links for three weeks before I noticed! Now I have a monthly “automation audit” where I check all my systems. I use Airtable to track everything – when it was last updated, what needs checking, and any issues that pop up.

The biggest mistake I see people make with passive income? Starting too big. My most successful passive income stream started as a simple $27 digital product. I focused on making that one product successful before adding more. Now I have a suite of products that all feed into each other, creating multiple passive income streams from the same customer base.

This might sound counterintuitive, but the most “passive” income often comes from active businesses that you’ve systematized. For instance, my online course used to require tons of hands-on support. Now I have a community moderator, automated welcome sequences, and FAQ videos that handle 90% of student questions. The income is pretty passive now, but it took months of active work to get there.

Technology is your best friend in creating passive income. I use Zapier to connect all my tools – when someone buys my course, it automatically adds them to my email list, sends them their login details, and even schedules a welcome text message. It’s like having a virtual assistant working 24/7, but it only costs me about $50 monthly for all the automation tools I use.

Remember this: passive income isn’t about doing nothing; it’s about doing the work once and getting paid for it multiple times. Start small, document everything (trust me, you’ll thank me later), and focus on creating systems that can run without your constant attention. And please, don’t get discouraged if your first attempt flops – my failed t-shirts taught me more about market research than any course ever could!

Unique and Emerging Income Opportunities

Let’s talk about new market trends first. One of the most interesting developments I’ve seen is the rise of virtual real estate. I dabbled in this space by buying a small plot in Decentraland for $500 last year. While it hasn’t made me rich, renting it out for virtual events has been bringing in about $100-150 monthly. The key is to spot these trends early but not bet the farm on them. I always follow the 5% rule – never invest more than 5% of my portfolio in emerging opportunities.

Now, about cryptocurrency income – this one’s been a wild ride! After losing some money trying to day trade (not my proudest moment), I discovered staking. It’s like earning interest on your crypto holdings. I stake some stable coins that earn around 5-7% APY. Much less stressful than trading! Pro tip: Start with well-established platforms and small amounts. I learned this the hard way after a smaller platform suddenly “went under maintenance” with some of my funds.

The sharing economy has been a surprisingly steady source of income. I started by renting out my parking space near the downtown area through an app called SpotHero. It brings in about $200 monthly – not life-changing money, but it’s essentially passive income from something I wasn’t using anyway. I’ve also experimented with renting out my camera equipment through ShareGrid. Photography gear is expensive, so why not let it pay for itself when I’m not using it?

Micro-investing platforms have completely changed the game for small investors like me. Remember when buying into commercial real estate meant having hundreds of thousands of dollars? Now I’m invested in several commercial properties through crowdfunding platforms, starting with as little as $100 per property. My favorite platform lets you earn rental income from large apartment complexes. Last quarter, my $2,000 investment generated $47 in passive income – not huge, but it’s growing!

Here’s something interesting about emerging opportunities: they often intersect in unexpected ways. For example, I discovered that some NFT projects offer royalties on secondary sales. I created a small collection of digital art pieces that continue generating small royalties whenever they’re resold. It’s not making me rich, but it’s fascinating to see how traditional concepts like royalties are being reimagined in the digital space.

One mistake I see people make is chasing every new trend. When NFTs were booming, I watched friends jump in without understanding the market. Instead, I spent three months learning about the technology and community before making my first investment. Patience really pays off in emerging markets!

The gig economy is evolving too. Instead of just driving for ride-share companies, I’ve found niche opportunities like being a virtual tour guide. I give online walking tours of my city to people planning their visits, charging $30 for a 45-minute personalized session. The demand surprised me – turns out people really value local expertise!

But here’s the most important lesson I’ve learned about emerging income streams: diversification is crucial. Some of these opportunities will boom, others will bust. I treat them like startup investments – high risk, high potential reward. That’s why I never put more than 20% of my investment budget into emerging opportunities combined.

Remember, the key to success with emerging income streams isn’t just spotting trends – it’s understanding them deeply enough to spot the real opportunities versus the hype. Take time to learn, start small, and don’t be afraid to experiment. Just make sure you’re using money you can afford to lose while you’re learning the ropes!

And one final piece of advice: keep excellent records of everything you try in emerging markets. The tax implications can get complicated quickly, especially with crypto and NFT income. Trust me, your future self (and your accountant) will thank you!

Managing and Scaling Multiple Income Streams

Let me share something I wish someone had told me when I first started juggling multiple income streams. I used to keep all my records in a messy spreadsheet (okay, several messy spreadsheets) and nearly had a meltdown during my first tax season. What a nightmare that was! These days, my system is much more streamlined, and I’m excited to share what I’ve learned the hard way.

First, let’s talk about tools and systems. QuickBooks was a game-changer for me, but I didn’t need it right away. I started with a simple Google Sheet tracking system – income in one tab, expenses in another, and a dashboard showing everything at a glance. Once I hit about $3,000 monthly from various sources, I upgraded to proper accounting software. Here’s my golden rule: every single income stream gets its own tracking system. I learned this after accidentally mixing my Etsy shop expenses with my rental property costs – my accountant wasn’t happy!

Speaking of accountants… can we talk about taxes for a minute? I made the mistake of waiting until March to think about tax implications. Big mistake. Huge! Now I have quarterly meetings with my accountant, and we use Loom videos to record our discussions so I can refer back to them. Pro tip: Set aside 30% of your income from day one for taxes. I keep this money in a separate high-yield savings account, so at least it’s earning a little interest while waiting for tax time.

The legal side of things scared me at first. I remember panicking when I realized I needed different types of insurance for different income streams. My rental property needed landlord insurance, my online business needed liability coverage, and my consulting work needed professional indemnity insurance. I found a great insurance broker who helped bundle everything together, saving me about $800 annually.

Let’s discuss reinvestment strategies – this is where the magic happens! I follow what I call the “40-40-20 rule.” 40% of profits go back into growing that specific income stream (like marketing or inventory), 40% goes into a general business growth fund, and 20% goes to my personal savings. This system prevented me from making the classic mistake of pulling too much money out of successful ventures too soon.

Time management was my biggest challenge (and honestly, some days it still is!). I used to think I needed to check on every income stream daily. Now I batch similar tasks together. Mondays are for financial reviews, Tuesdays for content creation, Wednesdays for maintenance and updates… you get the idea. I use ClickUp to manage everything, and it’s like having a personal assistant keeping me on track.

Here’s something nobody talks about enough – the importance of automation. I spent one full weekend setting up Zapier workflows to connect all my tools, and it saves me about 15 hours every month. For example, when someone books a consulting call through Calendly, it automatically creates an invoice in QuickBooks, sends a welcome email, and adds a task to my project management system. Worth every penny of the $20 monthly subscription!

Work-life balance? I had to learn this one the hard way. I used to answer client emails at midnight and check my Etsy shop sales during family dinner. Not anymore! Now I use iPhone’s Focus modes to turn off notifications from specific apps during personal time. The world won’t end if you don’t respond to that Upwork message until tomorrow morning – trust me on this one!

The scaling part is what really excites me now. Once you have systems in place, scaling becomes so much easier. I recently doubled my online course income simply by creating better automations and adding a few upsell opportunities. The key is to look for bottlenecks – what’s stopping each income stream from growing? Sometimes it’s as simple as improving one automated email sequence.

Here’s my biggest piece of advice: don’t try to scale everything at once. Focus on optimizing your most profitable stream first. I wasted months trying to grow all my income streams simultaneously, when I should have been focusing on the one that was already working well. Now I use a quarterly rotation system – each quarter, I focus on scaling one specific income stream while maintaining the others.

Remember, managing multiple income streams is a marathon, not a sprint. Set up good systems from the start, automate what you can, and most importantly, give yourself grace when things don’t go perfectly. Because trust me, they won’t – and that’s totally okay!

Building multiple income streams isn’t just about making more money—it’s about creating financial freedom and security for your future. By implementing the strategies we’ve discussed, you can start diversifying your income today. Remember, the key is to start small and scale gradually. Ready to take control of your financial future? Choose one strategy from this guide and take action today! Your future self will thank you.